FIRST INTERSTATE BANCSYSTEM (FIBK)·Q4 2025 Earnings Summary

First Interstate Smashes Earnings on $62.7M Branch Sale Gain, Boosts Buyback

January 28, 2026 · by Fintool AI Agent

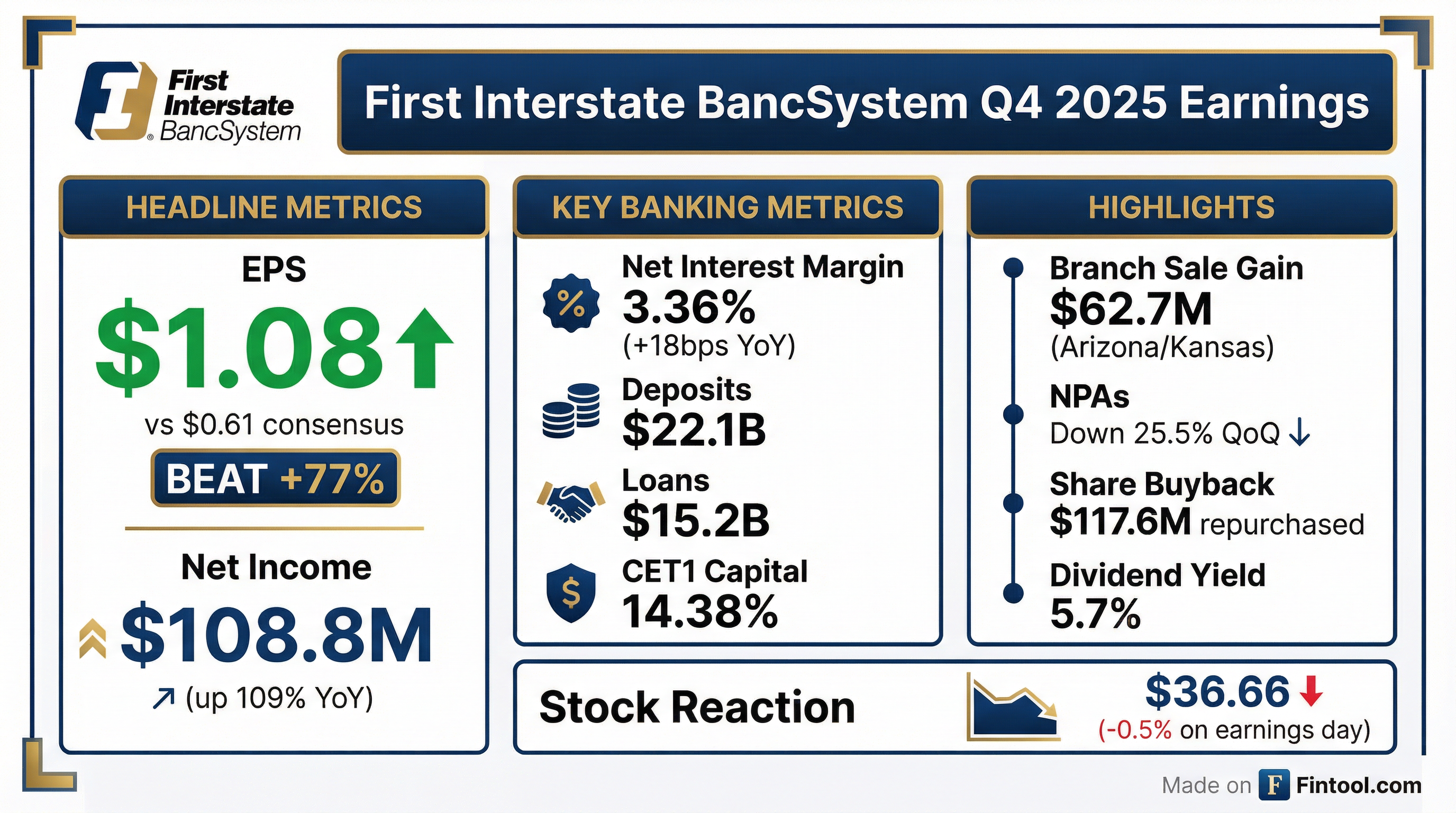

First Interstate BancSystem (NASDAQ: FIBK) delivered Q4 2025 earnings well above expectations, reporting net income of $108.8 million, or $1.08 per diluted share, compared to consensus of $0.61. The headline beat was driven by a $62.7 million gain from the sale of Arizona and Kansas branches that closed in October 2025. Even excluding this one-time item, normalized EPS of approximately $0.69 still beat consensus by 13%.

The regional bank continues executing on its strategic transformation — simplifying the branch network, returning capital aggressively through buybacks and dividends, and improving credit quality. Non-performing assets dropped 25.5% sequentially, and the Board authorized an additional $150 million in share repurchases.

Did First Interstate Beat Earnings?

Headline Beat, but Context Matters. The $1.08 EPS figure includes significant one-time items. Here's the breakdown:

The $62.7 million pre-tax gain from branch sales flowed through other income, boosting noninterest income to $106.6 million — up 144% from Q3 2025. Excluding this gain, underlying trends remained positive:

- Net interest margin expanded to 3.36%, up 2 bps sequentially and 18 bps year-over-year

- Adjusted FTE NIM reached 3.34%, up 4 bps from Q3 2025, driven by higher investment yields and lower deposit costs

- Efficiency ratio improved to 52.2%, benefiting from the gain recognition

What Changed From Last Quarter?

The quarter marked meaningful progress on FIBK's multi-pronged strategic plan:

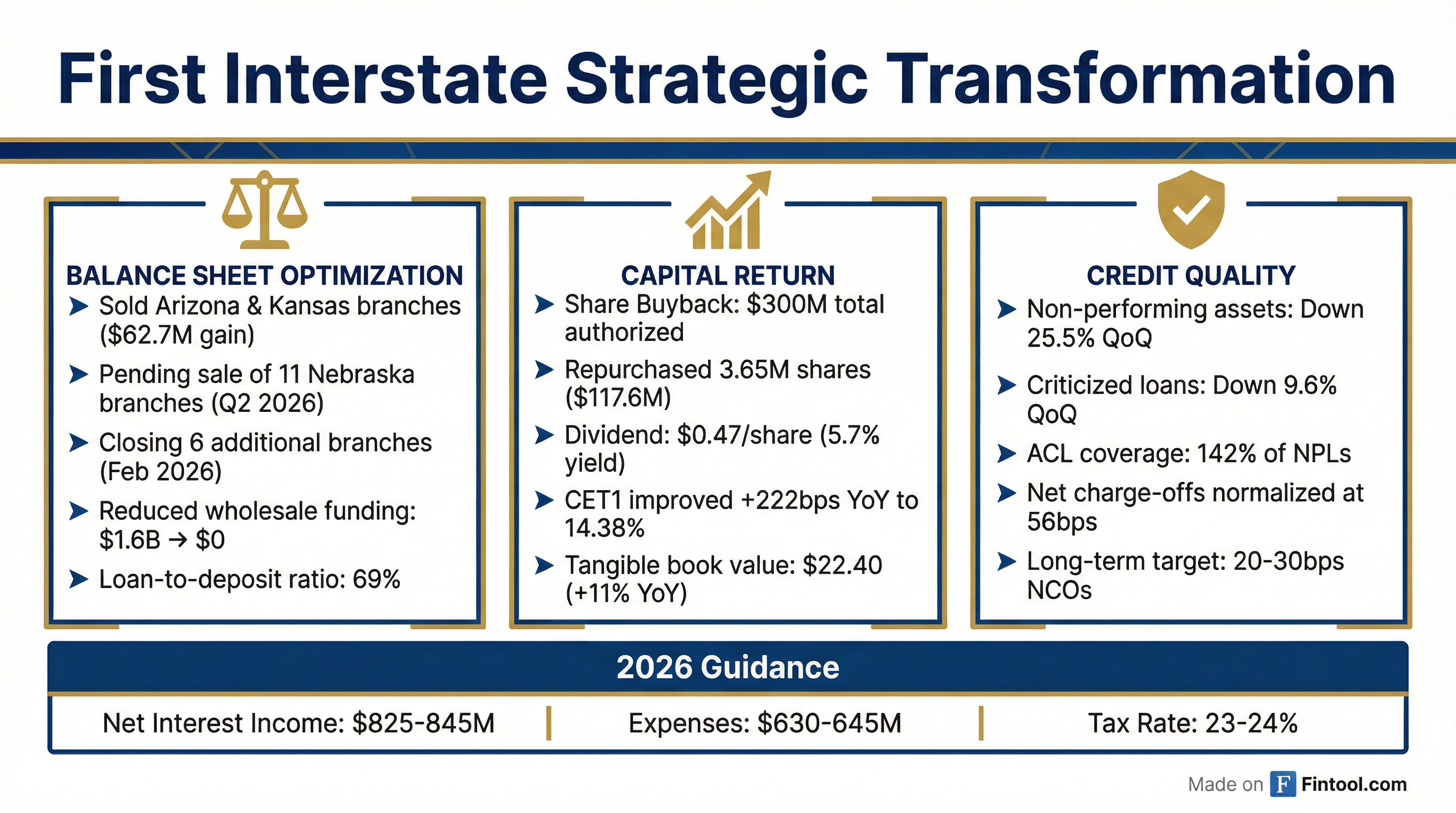

Balance Sheet Simplification

- Completed Arizona/Kansas branch sales — Sold $291.5M in loans and $641.6M in deposits, generating $62.7M gain

- Nebraska exit announced — 11 branches ($72.5M loans, $303.5M deposits) pending sale in Q2 2026, plus 4 branch closures in February

- Eliminated wholesale funding — Other borrowed funds dropped from $1.6B at year-end 2024 to zero

- Loan-to-deposit ratio declined to 68.8%, down from 77.5% a year ago

Capital Return Acceleration

- Buyback expansion — Board authorized additional $150M, bringing total program to $300M since August 2025

- Shares repurchased — 3.65M shares for $117.6M through year-end; 2.8M shares at $32.06 in Q4 alone

- CET1 ratio improved 48 bps sequentially to 14.38% (preliminary), up 222 bps year-over-year

Credit Quality Improvement

- Non-performing assets fell 25.5% QoQ to $138.3M

- NPL ratio improved to 0.89% of loans from 1.15% in Q3

- Criticized loans declined 9.6% QoQ to $1.05B

Banking Organization Redesign

First Interstate announced a major transformation of its banking organization in Q4, shifting from a layered regional/market structure to a flatter model with empowered state presidents.

CEO Jim Reuter described the change: "Our new state presidents represent high performers, a majority of which are from within the bank and select external talent, bringing proven track records of expertise, energy, and strong commitment to our institution."

The redesign is expected to be nearly complete in Q1 2026 and is viewed as "a significant driver of our expectation for improved organic growth" — with faster local decision-making and more people in production roles.

What Did Management Guide?

First Interstate provided detailed 2026 guidance, projecting continued margin expansion and disciplined expense control:

NIM Trajectory: CFO David Della Camera confirmed expectations for NIM to reach north of 3.50% by year-end 2026, representing sequential improvement of approximately 5 bps per quarter from the current 3.34% adjusted level.

Reinvestment Dynamics: On the Q&A call, management provided color on current reinvestment rates:

- New loan production: Low-to-mid 6% range on a weighted average basis

- Securities reinvestment: 5-year +60-70 bps, slightly lower than last quarter's +80-90 bps

CEO James Reuter emphasized the company's positioning: "We made continued, meaningful progress as we advance through each phase of our strategic plan. Our net interest margin continues to improve, we continued executing on our previously announced share repurchase program, and we were pleased to see reductions in non-performing and criticized assets."

How Did the Stock React?

FIBK shares closed at $36.66 on January 28, 2026, down 0.5% on the day of the earnings release. The muted reaction suggests the market was already pricing in strong capital return and credit improvement, with the one-time branch sale gain viewed as non-recurring.

Key stock metrics:

- Current price: $36.66 (as of market close 1/28/2026)

- 52-week range: $22.95 – $38.78

- Market cap: $3.8 billion

- Dividend yield: 5.7% annualized

- Price/tangible book: 1.64x (vs. $22.40 TBV per share)

The stock has rallied 60% from its 52-week low, reflecting investor confidence in the strategic turnaround and attractive capital return.

What Are the Key Risks?

Despite the positive quarter, several headwinds warrant monitoring:

-

Loan portfolio contraction — Loans declined 4.0% sequentially and 14.8% YoY as FIBK exits peripheral businesses (indirect auto, consumer credit cards) and runs off non-core portfolios

-

Deposit pressure — Total deposits declined $927M (-4.0%) YoY, partially due to branch sales but also reflecting competitive pressure

-

Net charge-offs elevated — Q4 NCOs spiked to 56 bps (annualized) driven by one large commercial relationship with a prior specific reserve

-

Geographic concentration — Montana (26%), South Dakota (16%), and Wyoming (13%) represent over half of deposits

-

Rate sensitivity — Guidance assumes two 25 bps rate cuts; more aggressive Fed easing could pressure NIM outlook

Loan Portfolio Deep Dive

FIBK's $15.2B loan portfolio is dominated by commercial real estate (54%) with diversified property types:

CRE breakdown by property type: Multifamily (23%), Retail (21%), Industrial/Warehouse (19%), Medical (12%), Office (10%), Hotel (10%)

The portfolio skews heavily non-metro (88% of CRE), reducing exposure to stressed urban office markets.

Forward Catalysts

- Nebraska branch sale closure — Expected early Q2 2026; will generate additional gain-on-sale

- Continued buybacks — $182M remaining under $300M authorization

- NIM expansion — $3.0B of fixed-rate loans at 4.5% repricing through 2027; $2.1B of securities at 2.6% generating reinvestment opportunity

- Credit normalization — If NCOs return to 20-30 bps target, provision expense could decline

Q&A Highlights

Key themes from the analyst Q&A session:

On Loan Growth Confidence (Jeff Rulis, D.A. Davidson): When asked about production challenges, CEO Jim Reuter acknowledged that credit culture adjustments and the banking org reset had temporarily impacted loan production, but expressed confidence: "The model we put in place, which combines disciplined credit management and a flatter, empowered, accountable leadership team, has led to good organic growth. When you combine that with our more focused franchise and brand density and growth markets, it gives me confidence in our ability to produce more in 2026."

On Competition (Andrew Terrell, Stephens): Management acknowledged increased competition on rates and terms but emphasized discipline: "We're not gonna grow for the sake of growth. We're gonna put on disciplined credits that are profitable, 'cause that's what'll ultimately enhance long-term shareholder value. We're 20 years without a credit cycle, and so I just think discipline matters."

On Buyback Cadence (Matthew Clark, Piper Sandler): CFO Della Camera confirmed the intent to continue active buybacks: "We want to approach that peer median over time... we've been meaningfully executing there, and we plan to continue executing. Of course, pace will be dependent on market conditions, but we absolutely intend to continue to be active on that buyback."

On 2027 Outlook (Jeff Rulis follow-up): Management sees continued margin improvement in 2027, with CFO noting that cash flow profiles from loans and securities become even more favorable. CEO Reuter added: "Assuming what we project in 2026 happens, we would expect to build on that into 2027."

On Colorado Expansion (Jared Shaw, Barclays): FIBK has built out a commercial banking team in Colorado and has the branch network it needs, focusing on full relationships: "Sometimes you have to do a couple things for a customer before they're like, 'Okay, I want to bring everything over to you.'"

The Bottom Line

First Interstate delivered a strong Q4, though the headline beat was heavily influenced by the $62.7M branch sale gain. The more important story is the continued execution on strategic priorities: balance sheet simplification, aggressive capital return, and credit quality improvement. With a 5.7% dividend yield, 14.4% CET1 ratio, and active buyback program, FIBK offers an attractive total return profile for income-focused investors willing to accept the loan book contraction phase.

Related: FIBK Company Profile | Q3 2025 Earnings | Earnings Transcript